Posted by jonathanfullarton - April 20, 2020 12:26 pm

Claim back Statutory Sick Pay (SSP) paid to employees due to coronavirus (COVID-19)

Posted by jonathanfullarton - April 20, 2020 12:26 pm

Claim back Statutory Sick Pay (SSP) paid to employees due to coronavirus (COVID-19)

Updated 23 February 2022

The Statutory Sick Pay Rebate Scheme (SSPRS) will close on Thursday 17 March. Any new claims to the scheme must be made by 24 March for any absence periods up to 17 March 2022. You must also ensure that you amend any claims you have previously submitted by the close off date of 24 March. You will not be able to use the Statutory Sick Pay Rebate Scheme for any employees who fall sick after 17 March.

Updated 4 February 2022

Portal now re-open for Statutory Sick Pay Rebate Scheme (SSPRS)

The Statutory Sick Pay Rebate Scheme (SSPRS) portal has been re-opened by HMRC to help employers deal with COVIID-19 sickness pay claims.

What is the Statutory Sick Pay Rebate Scheme

The Statutory Sick Pay Rebate Scheme enables employers with fewer than 250 employees to claim coronavirus-related Statutory Sick Pay (SSP).

HMRC have issued guidance on reclaiming back Statutory Sick Pay during the coronavirus pandemic. The Coronavirus Statutory Sick Pay Rebate Scheme will repay employers current rate of SSP that they pay to current or former employees for periods of sickness starting on or after 13 March 2020. If you are an employer, who pays more than the current rate of SSP, you can only claim the current rate amount.

How to claim

Before you make a claim you need to ensure that you:

- check that you can use the Coronavirus Statutory Sick Pay Rebate Scheme

- be registered for PAYE Online

- work out your claim period

You also need to ensure you have paid your employees’ sick pay before you claim.

Working out your claim period

You can claim for multiple pay periods and for multiple employees at the same time. For multiple claims, the claim periods can overlap.

Maximum number of employees you can claim for

The maximum number of employees you can claim for is the number you had across your PAYE schemes on 30 November 2021.

To complete your claim you’ll need the start and end dates of the claim period which is the:

- start date of the earliest pay period you’re claiming for – if the pay period started before 21 December 2021 you’ll need to use 21 December 2021 as the start date

- end date of the most recent pay period you’re claiming for – this must be on or before the date you make your claim (because you can only claim for SSP paid in arrears)

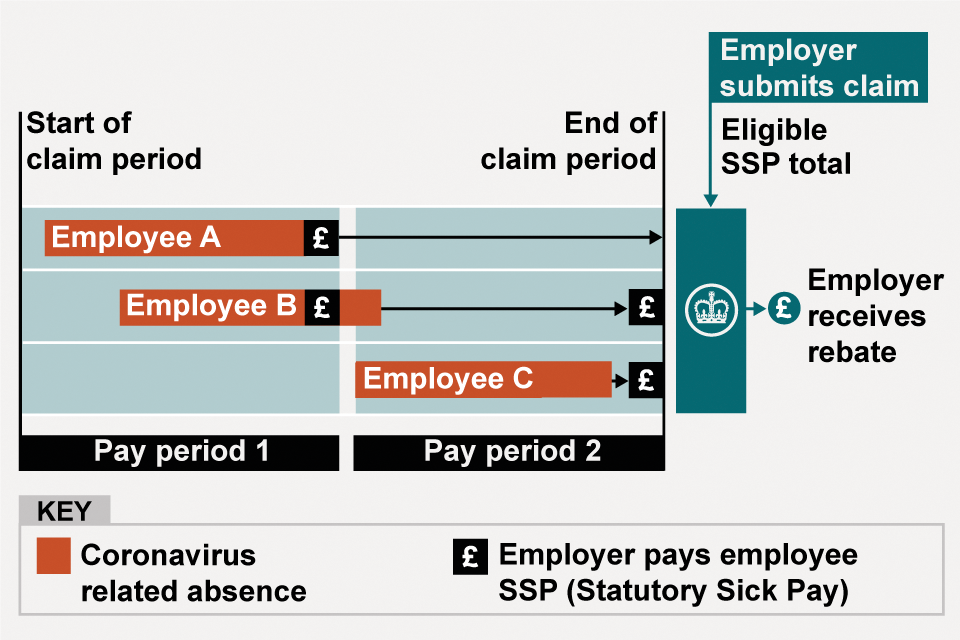

This HMRC image shows the example of an an employer claiming SSP for 3 employees over 2 pay periods with the claim starting on the first day of the first pay period, and ending on the last day of the second pay period. The claim amount is what’s paid to each employee capped at 2 weeks.

How to claim

Before you make a claim ensure you have the following information to hand:

- the number of employees you are claiming for

- start and end dates of your claim period

- the total amount of sick pay you’re claiming back – this should not exceed 2 weeks of the set SSP rate

- your Government Gateway user ID and password that you got when you registered for PAYE Online – if you do not have this find out how to get your lost user ID

- your employer PAYE reference number

- the contact name and phone number of someone we can contact if we have queries

- your UK bank or building society account details (only provide account details where a Bacs payment can be accepted) including:

- bank or building society account number (and roll number if it has one)

- sort code

- name on the account

- your address linked to your bank or building society account

Ensure you keep all records

Please keep all records of Statutory Sick Pay that you’ve paid and want to claim back from HMRC. These will need to be retained for a period of 3 years after the date you receive payment for your claim. Your records must cover:

- the dates your employee(s) were off sick

- which of those dates were qualifying days

- the reason they said they were sick, i.e., they had symptoms, someone they lived with had symptoms or they were shielding

- the employee’s National Insurance number

Keeping records will ensure you have all the information you need to provide HMRC with any supporting evidence should there be any a dispute over your payment of SSP.

You also need to print or save your state aid declaration (from your claim summary) and keep this until 31 December 2024.

How to claim

To make a claim click here: Claim now

If you are using an agent to make your claim

If you use an agent who is authorised to do PAYE Online for you, they will be able to claim on your behalf. You should speak to your agent about whether they are providing this service.

If you cannot claim online

Employers who are unable to claim online should have received a letter from HMRC detailing an alternative way to claim. If you have not received a letter then do contact Contact HMRC or call us for further help.

Once you have made your claim

HMRC will check your claim and if valid, pay monies into the account you supplied within 6 working days. Where employers knowingly and deliberately provide false or misleading information to benefit from the claim, HMRC will be applying penalties of up to £3000.

Checking the progress of your claim

You cannot check your progress online and you should only contact HMRC to check the progress of your claim if you have waited for more than 10 working days.

Other help available

Get help online

Use HMRC’s digital assistant to find more information about the coronavirus support schemes.

Employers are eligible to use the scheme if:

- they’re claiming for an employee who’s eligible for sick pay due to coronavirus

- they had a PAYE payroll scheme in operation before 28 February 2020

- they had fewer than 250 employees across all PAYE schemes on 28 February 2020

- they’re eligible to receive State Aid under the EU Commission Temporary Framework.

The repayment covers up to two weeks of the applicable rate of SSP, and is payable if a current or former employee was unable to work on or after 13 March 2020 and entitled to SSP, because they either:

- have coronavirus

- cannot work because they are self-isolating at home

- are shielding because they’ve been advised that they’re at high risk of severe illness from coronavirus.

Please note that employees do not have to give you a doctor’s fit note for you to make a claim.

How does the scheme work?

The scheme can be used by employers if they:

- are claiming for an employee who’s eligible for sick pay due to coronavirus

- had a PAYE payroll scheme that was created and started on or before 28 February 2020

- had fewer than 250 employees on 28 February 2020

What types of employment does the scheme cover?

The scheme covers all types of employment contracts, including:

- full-time employees

- part-time employees

- employees on agency contracts

- employees on flexible or zero-hour contracts

Connected companies and charities

Connected companies and charities can use the scheme providing their total combined number of PAYE employees are fewer than 250 on, or before 28 February 2020.

How long will the scheme last?

The government have not issued any details as to how long the scheme will last due to the current uncertainty that COVID-19 is causing. Instead, they have advised that they will let employers know in due course when the scheme will end.

We can help

As a tax agent we are able to make claims on behalf of employers. For more information as to how we can help please contact your local MFW office as listed below:

McCabe Ford Williams Cranbrook

McCabe Ford Williams Herne Bay

McCabe Ford Williams Maidstone

McCabe Ford Williams Sittingbourne

McCabe Ford Williams Accountants in Kent, London and the South East,