Posted by jonathanfullarton - January 25, 2021 4:20 am

Changes to late filing penalty for 2019-20 Self Assessment returns

Posted by jonathanfullarton - January 25, 2021 4:20 am

Changes to late filing penalty for 2019-20 Self Assessment returns

Today HMRC issued an announcement providing late Self Assessment tax payers with some good news.

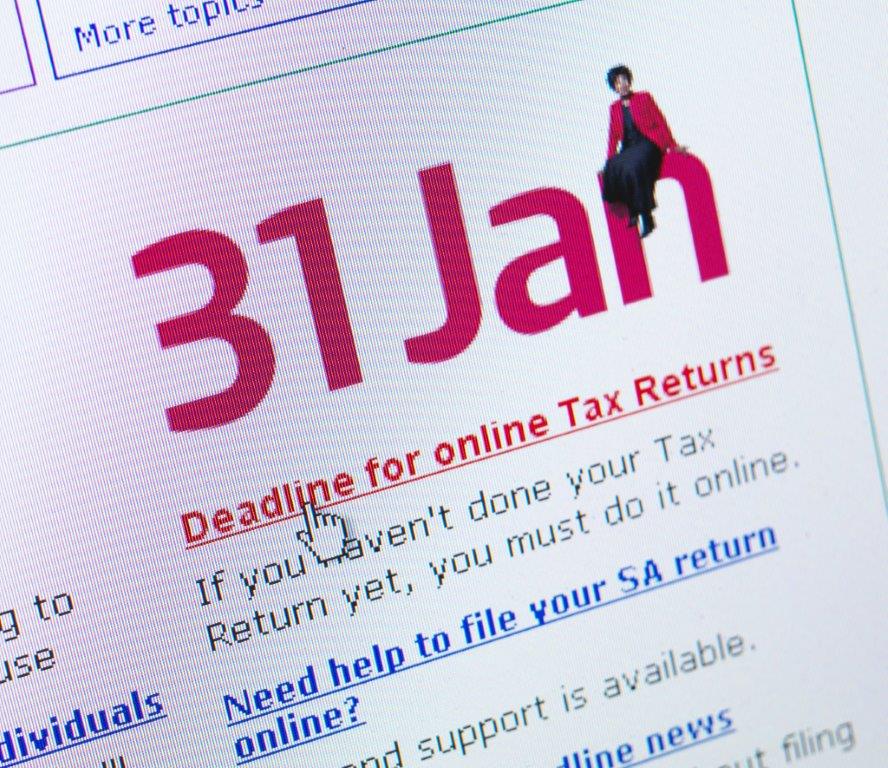

HMRC have confirmed that any late Self Assessment tax payers will not receive a penalty for filing their 2019-20 tax return late provided they do file online by 28 February 2021.

However, HMRC are still encouraging as many Self Assessment tax payers to meet the 31 January deadline, if possible. Self Assessment tax payers will still be required to pay their Self Assessment tax bill by 31 January with interestSelf Assessment late payment charged from 1 February on any liabilities.

Need help to pay?

If you are a Self Assessment tax payer and you are struggling to pay your entire tax liability on 31 January then help is at hand. You may be able to set up an affordable repayment plan and pay your tax via monthly instalments. However, you will need to file your Self Assessment tax return by the 31 January 2021 to qualify. For more information about payment plans click here.

Is completing your tax return too taxing?

With the increase of compliance issues and regulations and the impact of Covid this year you may be struggling with your tax matters. If you find yourself in that position please contact one of our tax specialists for help and advice by booking a free initial consultation.

We have been helping our clients keep more of what they earn since the firm was established. Here is some of the feedback we have received.

For more help contact your local MFW office.

Tax Planning for the new tax year

At McCabe Ford Williams we can also help you with tax planning for the new tax year so that you maximise all your tax allocations and make the most of your planning. For more help call your local MFW office. You can also download our End Of Year Tax Planning Strategy Guide here.